Fundamental Factors

- Bank of England (BoE) Policy: BoE held rates at 4.5%, with eight out of nine members voting for no change, signaling a gradual path to rate reductions.

- Wage Growth & Inflation Risks: UK wage growth remains strong at 5.9%, keeping inflation risks elevated despite expectations of declining rates.

- US Federal Reserve Stance: The Fed remains uncertain about the economic outlook, delaying rate cut expectations and strengthening the USD.

- Upcoming UK CPI Data (Wednesday): January CPI rose to 3% (from 2.5% in December)—a hotter-than-expected inflation print on Wednesday could limit BoE’s rate-cut flexibility and support GBP.

Key Takeaway for Traders

- GBP downside risk remains as the Fed’s cautious stance lifts the USD.

- UK inflation data next week is critical—a higher-than-expected CPI could slow BoE’s easing path and support GBP.

GBPNZD – H4 Timeframe

.png)

The recent bearish break of structure on the 4-hour timeframe chart of GBPNZD was followed by a retracement, which is currently reacting off the 76% Fibonacci retracement level. Due to an SBR pattern at the top of the swing high, I expect to see the price react from the highlighted supply zone, where the current high would be taken as a source of liquidity to propel the bearish continuation.

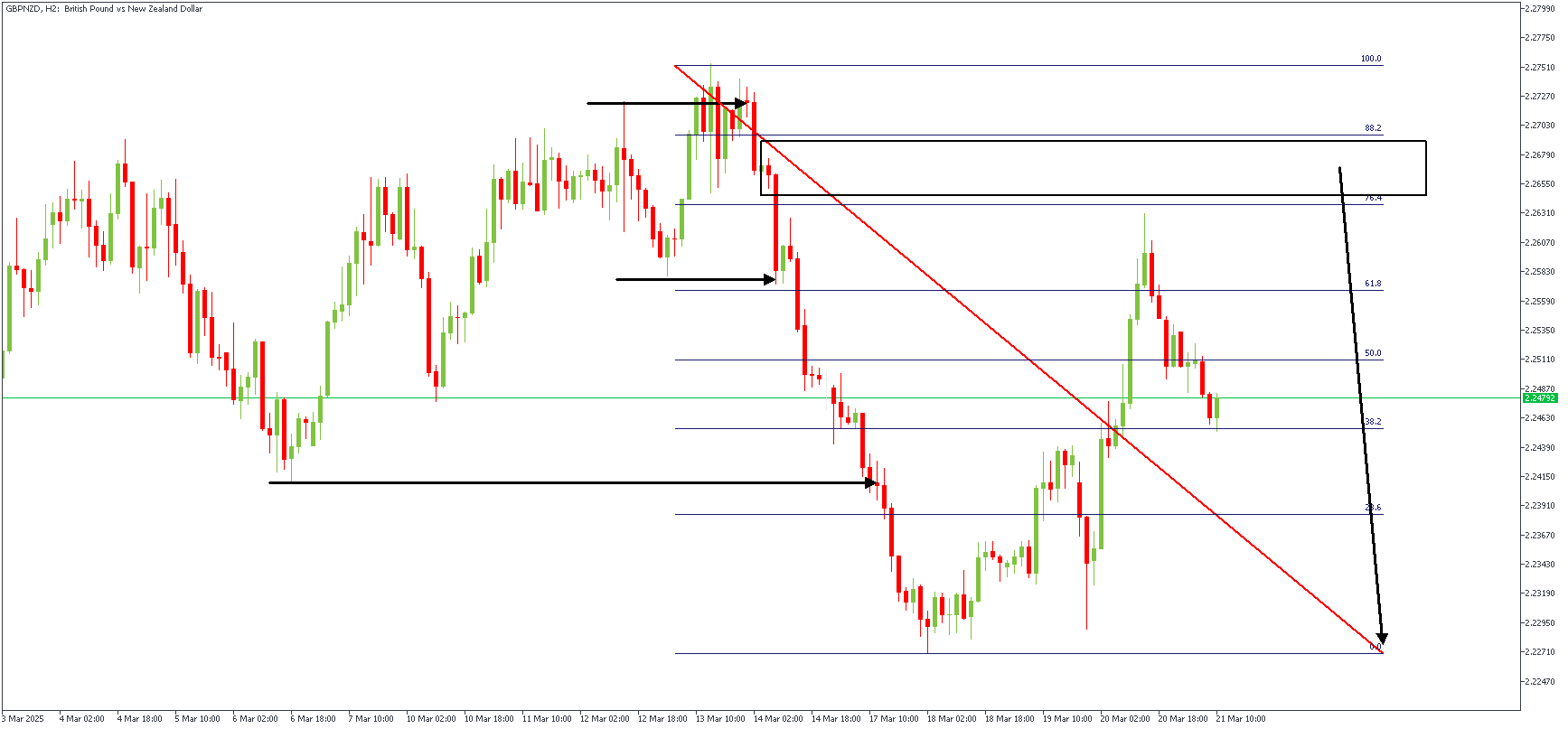

GBPNZD – H2 Timeframe

The 2-hour timeframe chart of GBPNZD shows the equal highs that the price movement has formed close to the 76% Fibonacci retracement zone. When such happens, price typical “mines” such inducement regions as a source of liquidity.

Analyst’s Expectations:

Direction: Bearish

Target- 2.22652

Invalidation- 2.27566

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.