.jpg)

About the ATR indicator

The ATR indicator shows how much an asset moves, on average, over a given time frame. In other words, it helps to determine the average size of the daily trading range. The indicator was developed by J. Welles Wilder Jr. in his book, New Concepts in Technical Trading Systems.

The indicator is calculated based on “true ranges”: It uses the absolute value of the current high minus the previous close, or the absolute value of the current low minus the previous close. The ATR represents a moving average of these ranges.

The ATR rises when trading is more volatile (price bars are long) and falls during periods of low volatility (price bars are short). The ATR is often used to determine the best position for stop-loss orders.

How to implement

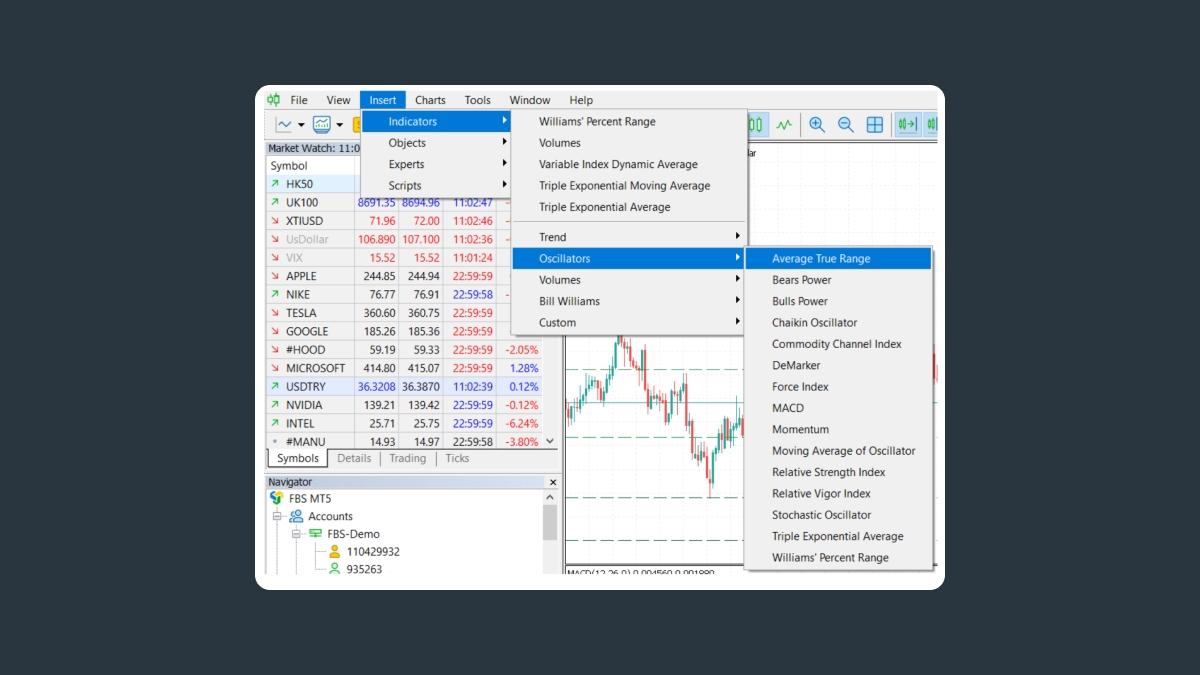

The ATR is a default feature of MetaTrader. You can add it to the chart by clicking Insert – Indicators – Oscillator and then choosing ATR.

By default, the default number of periods in MetaTrader is 14. If you choose a smaller number, the indicator will generate more trading signals, although the number of false signals will also increase. If you opt for a bigger number, the number of trading signals will likely decline.

The ATR can be used on any timeframe that is bigger than H1.

How to interpret

As we pointed out before, the average true range has two important applications. Let’s delve into them.

Notice that in MetaTrader, the indicator will show pips. An ATR reading of 0.0025 means 25 pips.

Using the ATR as a filter in trading

The indicator can be used as a filter of a trend. The higher the value of the indicator, the higher the probability of a trend’s change. The lower the indicator’s value, the weaker the trend’s movement.

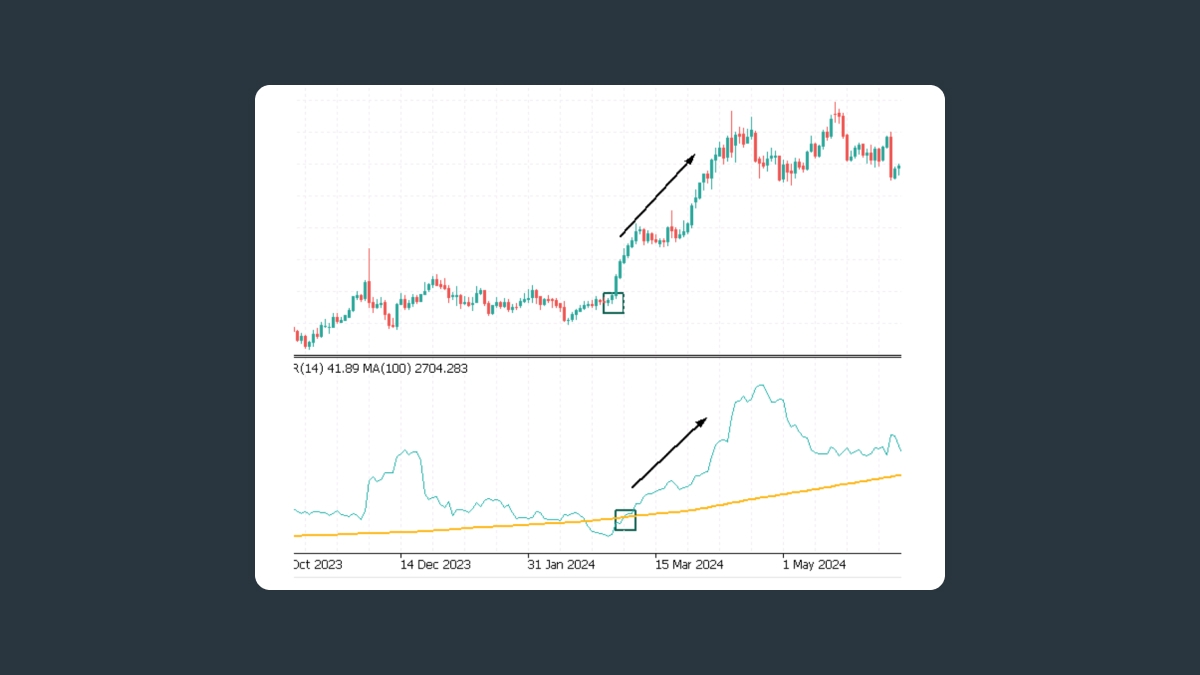

To analyze trends with the ATR you need a central line. When the indicator breaks it, the most significant moves of the market take place. There is no particular central line for this indicator, so it is estimated by eye. As an option, you can use a moving average with a big period like 100. To do this, choose Moving Average from MT4’s trend indicators in the Navigator panel, and then drag and drop it into the ATR indicator chart. In the window that pops up, go to the Parameters tab, open the Apply to dropdown menu, and choose First Indicator’s Data.

When the indicator is below the moving average, the market is calm. When the ATR breaks the moving average, a trend starts.

To confirm the trend, it makes sense to implement the indicator on several timeframes, for example, D1 and H1. If they move in the same direction and the ATR line breaks its moving average on the smaller timeframe, that means the market is becoming animated.

It’s also a good idea to apply an Envelopes indicator to your ATR. It works the same way as the central line: if the latter is below the envelopes’ lines, volatility is low. A break to the upside signals that the price action has become more intense.

Finally, the ATR can tell you whether it makes sense to trade. If the indicator value is bigger than, say, 20, the market is probably experiencing some extreme conditions. Usually, this happens when an important piece of news is out. If the ATR reading is smaller than 10, the price probably staggers, the candlesticks are small and hence the profit potential is limited. If you see that the market has already made a move equal to or exceeding the daily ATR, the odds are that it won’t move much in that direction on the same day. As a result, it’s probably not the best time to bet on the continuation of the movement. On the contrary, it may be sensible to look for the signals in the opposite direction.

Using the ATR to exit the market

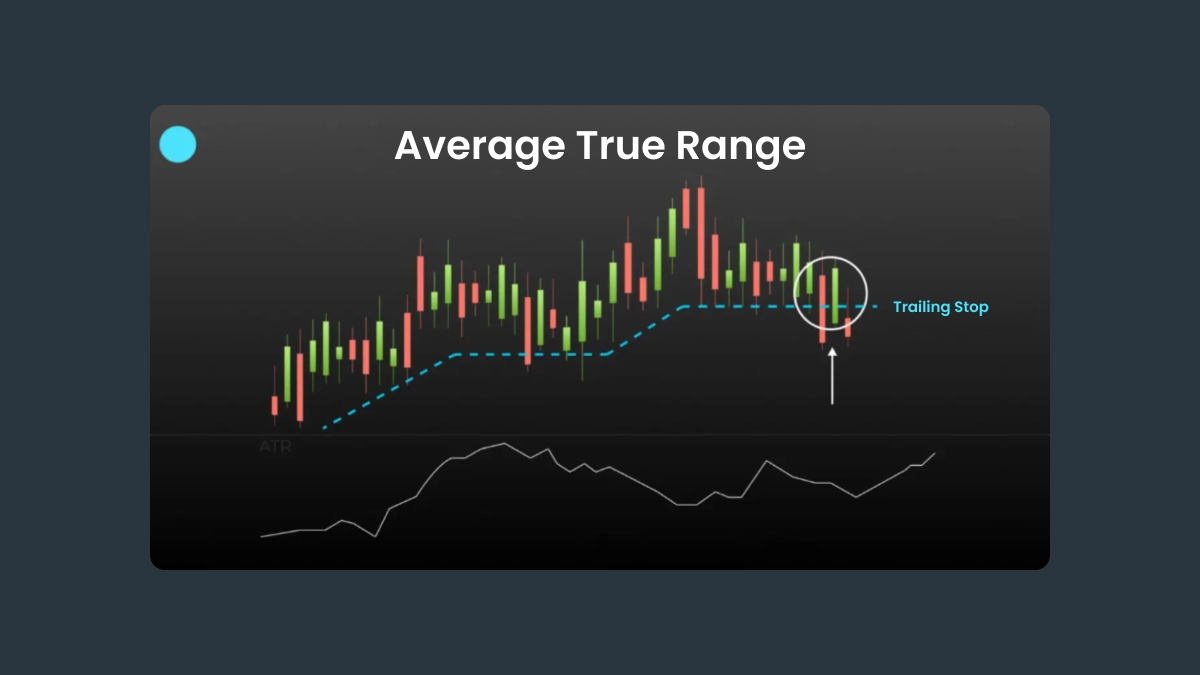

The ATR helps traders set stop-loss orders that take into account market volatility. That applies both for static and trailing stop-loss orders.

When the market is volatile, one should set wider stops in order to avoid being stopped out of the trading by some random market noise. When the volatility is low, one may set tighter stops. We recommend setting stops equal to 1-4 times of the ATR value.

As for trailing stops, you place a stop-loss at 2 x ATR below the entry price if buying, or 2 x ATR above the entry price if shorting.

Then there’s the so-called “chandelier exit” when a stop-loss is placed under the highest high the price has reached since you entered the buy trade. The distance between the highest high and the stop level is defined as some multiple times the ATR. For example, we could subtract three times the value of the ATR from the highest high since we entered the trade.

Summary

The ATR is commonly used in creating automated trading systems. It helps to build filters that take into account volatility or adapt different variables to the market. Those who trade manually often underestimate the benefits of the average true range indicator. Yet, it can do your trading a lot of good by making it more precise.